Navigating the world of cloud cost management can feel like charting unknown waters. Implementing a FinOps strategy is crucial for optimizing cloud spending, but choosing the right third-party tool can be a daunting task. This guide provides a structured approach to evaluate FinOps tools, empowering you to make informed decisions and achieve significant cost savings.

We will explore the essential features of FinOps tools, from cost visibility and optimization to reporting, automation, and security. This structured approach will help you assess vendor support, understand the importance of data accuracy, and ultimately, design a pilot program that aligns with your organization’s specific needs. By following this framework, you can confidently select a tool that unlocks the full potential of FinOps within your organization.

Understanding the FinOps Landscape

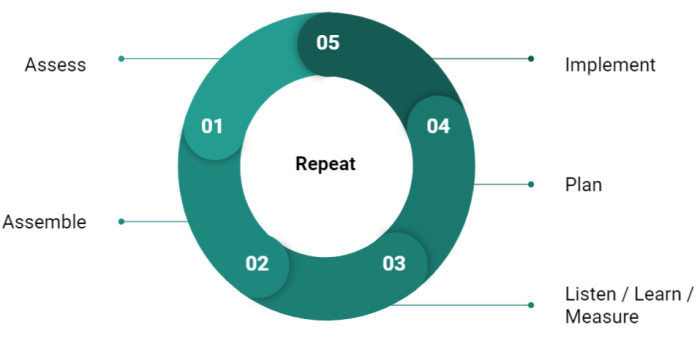

FinOps is a rapidly evolving cloud financial management discipline. It empowers organizations to achieve greater financial accountability and control over their cloud spending. This involves a collaborative effort across engineering, finance, and business teams to make data-driven decisions. It helps to maximize the value derived from cloud investments.

Core Principles of FinOps

FinOps is built upon several core principles that guide its implementation. These principles ensure that cloud costs are managed effectively and that value is maximized.

- Collaboration: This involves fostering open communication and shared responsibility among engineering, finance, and business teams. It ensures everyone understands cloud costs and how their actions impact them. This collaboration includes regular meetings, shared dashboards, and common goals.

- Cost Awareness: This principle emphasizes the importance of understanding and tracking cloud spending. It involves implementing tools and processes to monitor costs in real-time. Teams should have clear visibility into their spending patterns. This includes understanding what resources are being used, and how they are being used.

- Decentralized Ownership: Empowering teams to own their cloud spending and make informed decisions. It involves providing teams with the data and tools they need to manage their cloud resources effectively. This helps to promote accountability and drives cost optimization efforts at the team level.

- Continuous Optimization: FinOps is not a one-time effort. It is an ongoing process of identifying and implementing cost-saving opportunities. This includes regularly reviewing resource utilization, identifying idle resources, and optimizing configurations. Continuous optimization ensures that cloud spending is always aligned with business needs.

- Value-Driven Decisions: FinOps focuses on making decisions that maximize the value derived from cloud investments. This means balancing cost optimization with business needs. It involves prioritizing investments that provide the greatest return on investment (ROI). This ensures that cloud spending is aligned with business objectives.

FinOps Maturity Levels

Organizations typically progress through different FinOps maturity levels as they implement and refine their FinOps practices. These levels represent increasing sophistication in managing cloud costs. Each level builds upon the previous one, adding new capabilities and processes.

- Inform: At this initial level, organizations focus on gaining visibility into their cloud spending. They establish basic cost tracking and reporting. They are beginning to understand their cloud costs. Key activities include setting up cost dashboards and alerting.

- Optimize: Organizations at this level actively seek to optimize their cloud spending. They identify and implement cost-saving opportunities. This includes rightsizing resources, utilizing reserved instances, and implementing auto-scaling. They are proactively managing their cloud costs.

- Operate: At this stage, FinOps becomes an integral part of the organization’s operations. Teams automate cost management processes and integrate FinOps into their development workflows. They focus on continuous improvement and proactive cost governance. They are integrating FinOps into their day-to-day operations.

- Automate: Organizations at this advanced level leverage automation to drive cost efficiency. They automate cost optimization, anomaly detection, and resource allocation. They use sophisticated tools and techniques to proactively manage their cloud costs. They are using automation to optimize their cloud spending.

- Innovate: The highest level of maturity involves using FinOps to drive innovation and business value. Organizations use FinOps insights to inform strategic decisions. They are experimenting with new cloud services and architectures to maximize ROI. They are leveraging FinOps to drive business innovation.

Benefits of Implementing FinOps within an Organization

Implementing FinOps offers numerous benefits for organizations using cloud services. These benefits contribute to greater financial efficiency, improved decision-making, and increased business value.

- Cost Savings: FinOps helps organizations identify and eliminate unnecessary cloud spending. This includes rightsizing resources, eliminating idle resources, and optimizing configurations. Many organizations have reported significant cost savings after implementing FinOps.

- Improved Visibility: FinOps provides greater visibility into cloud spending patterns. Teams can understand where their money is being spent and identify areas for improvement. This transparency allows for data-driven decision-making.

- Enhanced Accountability: FinOps promotes shared responsibility for cloud costs. Engineering, finance, and business teams collaborate to manage spending effectively. This shared accountability drives cost optimization efforts.

- Faster Innovation: By providing better cost control and predictability, FinOps allows organizations to experiment with new cloud services and architectures. This accelerates innovation and time-to-market. Teams can quickly try new things without worrying about uncontrolled spending.

- Better Business Decisions: FinOps provides the data and insights needed to make informed business decisions. Organizations can better understand the cost implications of their cloud investments. They can prioritize investments that provide the greatest return on investment.

- Increased Agility: FinOps helps organizations become more agile and responsive to changing business needs. They can quickly scale resources up or down to meet demand. They can adapt their cloud spending to align with their business goals.

Defining Evaluation Criteria for FinOps Tools

Evaluating FinOps tools requires a structured approach to ensure the chosen solution aligns with your organization’s specific needs and objectives. This involves defining clear criteria that encompass essential features, cost management capabilities, reporting functionalities, and alerting mechanisms. A well-defined evaluation process will help you select a tool that effectively supports your FinOps practice and drives cloud cost optimization.

Essential Features of a FinOps Tool

A robust FinOps tool should possess a core set of features to effectively manage and optimize cloud spending. These features are fundamental to achieving cost efficiency and informed decision-making.The essential features include:

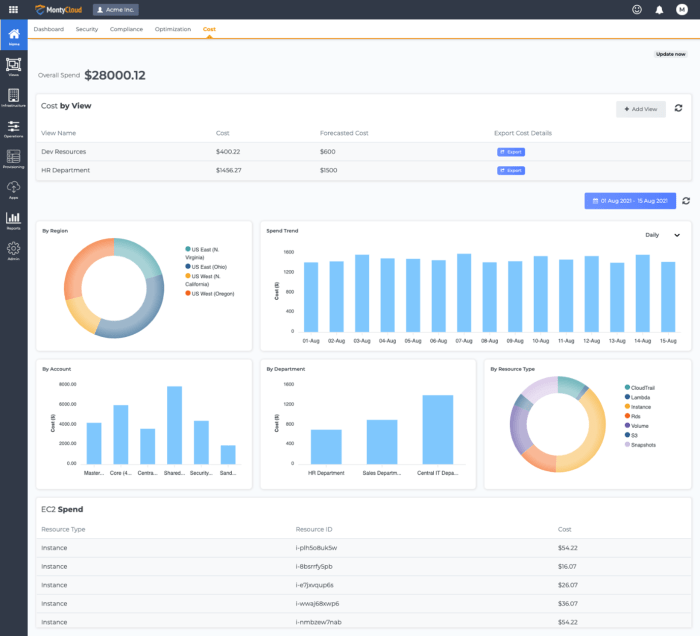

- Cost Visibility and Tracking: The ability to provide granular cost data, broken down by service, resource, and business unit, is crucial. This includes real-time cost monitoring and historical trend analysis.

- Cost Allocation: Accurate allocation of cloud costs to specific teams, projects, or departments is essential for accountability and chargeback/showback processes. This often involves tagging and custom dimensions.

- Budgeting and Forecasting: Tools should allow for setting budgets, forecasting future cloud spending, and receiving alerts when spending approaches or exceeds predefined thresholds.

- Anomaly Detection: Automated identification of unusual spending patterns or unexpected cost increases helps prevent cost overruns and identify potential issues early on.

- Recommendations and Optimization: The tool should offer actionable recommendations for optimizing cloud resources, such as rightsizing instances, eliminating idle resources, and leveraging reserved instances or committed use discounts.

- Integration Capabilities: Seamless integration with existing cloud providers (AWS, Azure, GCP) and other relevant systems (e.g., ITSM, CI/CD pipelines) is vital for data flow and automation.

- Reporting and Analytics: Customizable dashboards, reports, and data visualization capabilities are necessary to communicate cost information effectively to various stakeholders.

- Automation and Orchestration: The ability to automate cost-saving actions, such as shutting down unused resources or scaling resources based on demand, can significantly reduce costs.

Importance of Cost Visibility and Allocation

Cost visibility and allocation are foundational pillars of a successful FinOps practice. Without these capabilities, it is impossible to understand where costs are incurred, who is responsible for them, and how to optimize spending effectively.Effective cost visibility provides the following benefits:

- Improved Decision-Making: Clear visibility into cloud spending allows for informed decisions regarding resource allocation, application architecture, and technology choices.

- Enhanced Accountability: When costs are clearly allocated, teams and individuals become more accountable for their cloud usage, leading to more responsible spending habits.

- Proactive Cost Management: Real-time cost monitoring and trend analysis enable proactive identification and mitigation of cost issues before they escalate.

- Accurate Chargeback/Showback: Cost allocation facilitates accurate chargeback or showback processes, allowing organizations to bill internal teams or departments for their cloud usage.

Cost allocation is typically achieved through:

- Tagging: Applying tags to cloud resources allows for grouping and categorizing costs based on various criteria (e.g., project, environment, team).

- Custom Dimensions: Some tools support custom dimensions, enabling more flexible and detailed cost allocation based on specific business needs.

- Data Aggregation: The tool should be able to aggregate cost data from multiple sources and provide a unified view of cloud spending.

For example, a company might use tags to allocate costs to different development teams. The “Team A” tag would aggregate the costs associated with all resources used by Team A, providing a clear view of their cloud spending. Another company may use custom dimensions to identify the cost of each product based on different services.

Comparing Reporting and Alerting Capabilities

Reporting and alerting capabilities are crucial for communicating cost information, identifying anomalies, and taking timely action to optimize cloud spending. Different FinOps tools offer varying levels of sophistication in these areas.When comparing tools, consider the following aspects of reporting:

- Customization: The ability to create custom dashboards and reports tailored to specific needs and audiences is essential.

- Data Visualization: Effective data visualization, including charts, graphs, and tables, helps communicate cost information clearly and concisely.

- Scheduling and Automation: The ability to schedule reports and automate their delivery to stakeholders saves time and ensures timely access to cost data.

- Data Export: The ability to export reports in various formats (e.g., CSV, PDF) allows for easy data sharing and analysis.

Alerting capabilities should include:

- Threshold-Based Alerts: The ability to set thresholds for cost, usage, or performance metrics and receive alerts when these thresholds are breached.

- Anomaly Detection Alerts: Automated alerts that identify unusual spending patterns or unexpected cost increases.

- Custom Alerting Rules: The ability to define custom alerting rules based on specific business requirements.

- Notification Channels: Support for multiple notification channels (e.g., email, Slack, Microsoft Teams) to ensure timely delivery of alerts.

For example, a tool might offer a dashboard that displays real-time cost data, broken down by service and resource. Users can customize the dashboard to show the metrics most relevant to their roles. The same tool could provide alerts when a specific service’s cost exceeds a predefined budget, notifying the relevant team via email and Slack.

Assessing Cost Optimization Capabilities

Evaluating a FinOps tool’s cost optimization capabilities is crucial for maximizing cloud spend efficiency. This involves scrutinizing how the tool identifies, analyzes, and facilitates the reduction of unnecessary cloud costs. A robust tool will offer a suite of features to proactively manage and optimize resource utilization. This section will detail methods for analyzing cost optimization features, procedures for evaluating resource rightsizing effectiveness, and examples of tools offering automated cost optimization recommendations.

Analyzing Cost Optimization Features in Tools

A comprehensive assessment of cost optimization features should encompass various aspects of the tool’s functionality. This ensures a holistic understanding of its ability to reduce cloud spending effectively.To analyze cost optimization features effectively, consider the following:

- Cost Visibility and Reporting: Evaluate the tool’s ability to provide detailed cost breakdowns. This includes filtering and grouping costs by service, resource, and other relevant dimensions. Ensure the tool offers customizable dashboards and reports to visualize spending trends.

- Anomaly Detection: Determine if the tool can automatically detect unusual spending patterns. It should alert users to unexpected cost increases or deviations from established baselines. This proactive approach helps prevent runaway costs.

- Recommendations Engine: Examine the engine’s capacity to generate actionable recommendations. These recommendations should cover various optimization strategies, such as rightsizing, instance selection, and reserved instance utilization.

- Automation Capabilities: Assess the tool’s ability to automate cost optimization tasks. This may include automatically scaling resources, implementing cost-saving policies, or scheduling resource shutdowns. Automation minimizes manual effort and ensures consistent optimization.

- Integration with Cloud Providers: Verify the tool’s compatibility and integration with the major cloud providers (AWS, Azure, GCP). It should seamlessly ingest cost and usage data from these platforms.

- Data Accuracy and Granularity: Check the accuracy of the data and the level of detail it provides. More granular data allows for more precise cost analysis and optimization efforts.

- Historical Data Analysis: The tool should analyze historical cost and usage data to identify trends and patterns. This is essential for making informed decisions about future resource allocation and cost optimization strategies.

Designing a Procedure to Evaluate the Effectiveness of Resource Rightsizing

Resource rightsizing, the process of matching resource capacity to actual demand, is a cornerstone of cost optimization. Evaluating its effectiveness involves a structured approach to measure the impact of the tool’s recommendations.To evaluate the effectiveness of resource rightsizing, follow this procedure:

- Define Baseline: Establish a baseline of current resource utilization and costs. This involves collecting data on CPU utilization, memory usage, network traffic, and storage capacity. This baseline will serve as a reference point for measuring improvements.

- Identify Candidate Resources: Identify resources that the tool recommends for rightsizing. These might include over-provisioned virtual machines, idle databases, or underutilized storage volumes.

- Implement Rightsizing Recommendations: Implement the tool’s rightsizing recommendations. This could involve downscaling instances, reducing storage capacity, or consolidating resources.

- Monitor Resource Utilization: Continuously monitor resource utilization after rightsizing. Ensure that the resources are still meeting the performance requirements of the applications. This involves tracking key metrics such as CPU utilization, memory usage, and response times.

- Track Cost Savings: Measure the cost savings achieved through rightsizing. Compare the costs before and after implementation. Calculate the percentage reduction in costs.

- Analyze Performance Impact: Evaluate the impact of rightsizing on application performance. Ensure that there are no performance degradations. This may involve monitoring application response times, error rates, and other relevant metrics.

- Iterate and Refine: Based on the results, iterate and refine the rightsizing strategy. This may involve adjusting the size of resources or re-evaluating the tool’s recommendations.

A practical example: A company utilizes a FinOps tool to identify an over-provisioned EC2 instance running a web application. The tool recommends downsizing from a `c5.xlarge` instance to a `c5.large` instance. After implementing the recommendation, the company observes a 30% reduction in the instance’s cost while maintaining acceptable application performance.

Examples of Tools that Offer Automated Cost Optimization Recommendations

Several FinOps tools offer automated cost optimization recommendations, streamlining the process of reducing cloud spending. These tools leverage machine learning and data analytics to identify opportunities for optimization and provide actionable insights.Here are examples of tools with automated cost optimization features:

- AWS Cost Explorer and Cost Optimization Services: AWS offers built-in tools like Cost Explorer and services like Compute Optimizer. Compute Optimizer analyzes historical usage data to recommend optimized instance types and sizes. Cost Explorer provides detailed cost breakdowns and allows users to set budgets and track spending. These native tools provide a foundational level of cost optimization.

- Azure Cost Management + Billing: Azure’s Cost Management + Billing service provides cost analysis, budgeting, and recommendations for optimizing Azure resources. It identifies underutilized resources, suggests right-sizing opportunities, and helps users identify and eliminate waste.

- Google Cloud Cost Management: Google Cloud’s cost management tools include recommendations for rightsizing, committing to sustained use discounts, and identifying idle resources. These tools are integrated with Google Cloud’s billing and resource management services.

- CloudHealth by VMware: CloudHealth provides comprehensive cost management and optimization capabilities. It offers automated recommendations for rightsizing, instance selection, and reserved instance utilization. The tool also provides a governance framework to enforce cost-saving policies.

- Apptio Cloudability: Apptio Cloudability offers detailed cost analysis, reporting, and recommendations for optimizing cloud spending. It identifies cost-saving opportunities, such as rightsizing and reserved instance utilization, and provides insights into cost trends and anomalies.

Evaluating Reporting and Analytics Features

Accurate and insightful reporting is a cornerstone of effective FinOps. The ability to visualize cost data, track key performance indicators (KPIs), and generate custom reports is crucial for understanding cloud spending, identifying optimization opportunities, and making informed decisions. This section delves into the critical aspects of evaluating the reporting and analytics features of third-party FinOps tools.

Key Performance Indicators (KPIs) for FinOps

Establishing clear KPIs is fundamental to measuring the success of FinOps initiatives. These metrics provide a quantifiable way to track progress, identify areas for improvement, and demonstrate the value of FinOps practices.Here are some crucial KPIs for FinOps:

- Cost Efficiency: This measures how effectively cloud resources are being utilized. It’s a broad category encompassing several metrics.

- Cost per Unit: This metric helps to understand the cost associated with delivering a specific unit of output, such as a transaction, user, or product. It is useful for tracking the cost efficiency of applications or services.

- Cost per Customer: Measures the cost of serving each customer, allowing businesses to assess profitability and identify cost-saving opportunities in customer-facing operations.

- Cost per Transaction: This KPI focuses on the cost associated with processing individual transactions, such as online purchases or data requests.

- Cloud Spend: The total amount spent on cloud services over a specific period.

- Cost Variance: The difference between the planned or budgeted cloud spend and the actual spend.

- Waste Percentage: The percentage of cloud spend that is considered unnecessary or inefficient. This can include idle resources, over-provisioned instances, or unused storage.

- Resource Utilization: This tracks how effectively cloud resources are being used, often expressed as a percentage of CPU, memory, or storage utilization.

- Rightsizing Opportunities Identified: The number of instances or resources identified for rightsizing, such as downsizing or consolidating.

- Savings Realized: The actual cost savings achieved through optimization efforts.

- Forecast Accuracy: The accuracy of cloud spend forecasts, which helps with budgeting and resource allocation.

- Chargeback/Showback Accuracy: This measures the accuracy and efficiency of allocating cloud costs to different departments or teams.

- Automation Rate: The extent to which FinOps processes are automated, reducing manual effort and improving efficiency.

Demonstrating How Different Tools Visualize Cost Data

Effective data visualization is essential for quickly understanding complex cost information. Different FinOps tools employ a variety of techniques to present cost data in an intuitive and actionable manner.Tools commonly utilize these visualization techniques:

- Interactive Dashboards: These provide a central view of key metrics, allowing users to drill down into specific areas of interest. Dashboards often include charts, graphs, and tables that can be customized to display relevant data.

- Trend Charts: These charts display cost trends over time, enabling users to identify patterns, anomalies, and potential areas of concern. They can show the growth of spending in a specific service, region, or application.

- Heatmaps: Heatmaps can be used to visualize cost allocation across different dimensions, such as services, regions, or teams. They use color-coding to highlight areas of high or low spending.

- Cost Allocation Trees: These allow users to visualize the hierarchical breakdown of costs, from high-level categories down to individual resources.

- Anomaly Detection: Some tools employ algorithms to automatically detect unusual spending patterns, alerting users to potential issues.

- Forecasting Graphs: These visually project future cloud spending based on historical data and current usage patterns. They often provide different scenarios (e.g., best-case, worst-case) to help with planning.

For example, consider the visualization capabilities of a hypothetical tool, “CloudInsights Pro.” CloudInsights Pro might present cost data using the following methods:

- Interactive Dashboards: The main dashboard displays a summary of key metrics, such as total spend, cost variance, and waste percentage. Users can customize the dashboard to show the metrics most relevant to their role.

- Trend Charts: Users can view line graphs of cost trends over time, broken down by service, region, or other dimensions. The tool might also allow users to compare different time periods to identify changes in spending.

- Heatmaps: A heatmap could visualize cost allocation across different departments or teams, highlighting areas where spending is concentrated.

- Cost Allocation Trees: The tool might present a tree diagram showing the breakdown of costs, starting with the total spend and drilling down to individual resources and their associated costs.

- Anomaly Detection: CloudInsights Pro could automatically detect unusual spending patterns, such as a sudden spike in the cost of a specific service, and alert users to investigate.

Providing Examples of Custom Reporting Capabilities Offered by Various Tools

Custom reporting capabilities allow users to generate reports tailored to their specific needs. This flexibility is crucial for gaining deeper insights into cloud spending and communicating those insights to different stakeholders.Here are some examples of custom reporting features:

- Report Generation: Users can create reports that include specific metrics, dimensions, and filters.

- Scheduled Reports: Reports can be automatically generated and delivered on a regular schedule (e.g., daily, weekly, monthly).

- Report Customization: Users can customize the format and layout of reports, including the choice of charts, tables, and other visualizations.

- Data Export: Reports can be exported in various formats, such as CSV, Excel, and PDF, for further analysis or sharing.

- Alerting and Notifications: Reports can trigger alerts or notifications when specific thresholds are met.

Here are examples of custom reporting features found in different FinOps tools:

- Tool A: Allows users to create custom reports that track cost by business unit, including metrics such as cost per transaction and cost per customer. These reports can be scheduled to run automatically and delivered to stakeholders via email. Users can also set up alerts based on budget overruns or unexpected cost increases.

- Tool B: Offers a drag-and-drop report builder that enables users to create reports with a variety of visualizations, including bar charts, pie charts, and line graphs. Users can filter data by service, region, tag, and other dimensions. The tool also supports exporting reports in various formats, including CSV, Excel, and PDF.

- Tool C: Provides pre-built report templates for common FinOps use cases, such as cost optimization, resource utilization, and anomaly detection. Users can customize these templates to fit their specific needs. The tool also integrates with popular business intelligence tools, allowing users to leverage their existing reporting infrastructure.

Examining Integration and Automation

Integrating a FinOps tool seamlessly with your existing cloud infrastructure and automating key processes are crucial for maximizing its effectiveness. These capabilities determine how easily the tool can gather data, provide insights, and implement cost-saving measures. A well-integrated and automated tool streamlines FinOps practices, allowing your team to focus on strategic initiatives rather than manual tasks.

Integration with Cloud Providers

Effective FinOps requires a deep understanding of cloud spending and resource utilization. This understanding relies heavily on the ability of the FinOps tool to integrate directly with your cloud providers. The tool’s integration capabilities directly impact the accuracy, completeness, and timeliness of the data it provides.

- Native Integrations: Look for tools that offer native, out-of-the-box integrations with your primary cloud providers (AWS, Azure, Google Cloud). These integrations should provide comprehensive data access, including cost and usage data, resource metadata, and billing details. The level of integration should allow for granular data collection, such as at the service, resource, and tag level.

- Data Freshness: Evaluate how frequently the tool updates its data. Real-time or near-real-time data updates are ideal, allowing for prompt identification of cost anomalies and opportunities for optimization. Consider the data latency, the time it takes for data to be processed and displayed within the tool.

- API Access and Connectivity: The tool should leverage robust APIs to connect to cloud provider services. These APIs should facilitate both data ingestion and the ability to make changes (e.g., rightsizing resources, turning off unused instances). Ensure the tool supports secure API authentication methods.

- Multi-Cloud Support: If you utilize multiple cloud providers, ensure the tool supports integrations with all of them. This unified view is essential for comprehensive cost management and optimization across your entire cloud footprint.

- Data Security and Compliance: Verify that the tool adheres to your organization’s security and compliance requirements. This includes data encryption, access controls, and compliance with relevant regulations (e.g., GDPR, HIPAA). Review the provider’s security certifications and practices.

Assessing Automation Capabilities

Automation is a cornerstone of effective FinOps. Automating key processes reduces manual effort, minimizes errors, and enables faster response times to cost-related issues. The level of automation a FinOps tool provides can significantly impact your team’s efficiency and the overall success of your FinOps initiatives.

- Policy Enforcement: Determine if the tool allows you to define and enforce cost policies automatically. This could include policies to shut down idle resources, resize underutilized instances, or enforce budget limits.

- Alerting and Notifications: The tool should offer customizable alerting capabilities. Alerts should be triggered based on pre-defined thresholds for cost, usage, or performance metrics. Notifications should be sent to the appropriate stakeholders, providing context and recommendations for action.

- Workflow Automation: Investigate the tool’s ability to automate workflows, such as rightsizing recommendations or the deployment of cost-saving configurations. Look for features like automated instance resizing, automated tag application, or automated scheduling of resource utilization.

- API-Driven Automation: A FinOps tool’s automation capabilities are greatly enhanced by its ability to be controlled via APIs. This allows you to integrate the tool with other systems and build custom automation workflows.

- Integration with DevOps Tools: The ability to integrate with DevOps tools like CI/CD pipelines can further streamline automation. This allows for cost optimization to be built directly into the development lifecycle.

Examples of Automation Workflows

Automation workflows can significantly streamline FinOps practices, allowing for proactive cost management and resource optimization. Here are some examples of automation workflows that can be implemented:

- Idle Resource Detection and Shutdown: The FinOps tool identifies idle resources (e.g., virtual machines, databases) based on utilization metrics. The tool then automatically shuts down these resources after a pre-defined period of inactivity, saving costs. For example, an EC2 instance that has been idle for more than 24 hours could be automatically shut down.

- Rightsizing Recommendations and Automation: The tool analyzes resource utilization data and provides recommendations for rightsizing resources (e.g., resizing an EC2 instance to a smaller size based on CPU and memory usage). The tool then automatically resizes the resources based on pre-approved configurations, reducing costs.

- Budget Alerts and Automated Actions: The tool monitors cloud spending against predefined budgets. When a budget threshold is reached or exceeded, the tool triggers alerts to the relevant stakeholders. It can also automatically execute actions, such as shutting down non-critical resources or scaling back services to reduce spending.

- Tagging Automation: Automate the application of tags to resources based on predefined rules. For example, automatically apply a cost center tag based on the resource’s deployment location or the user who created it. This ensures consistent tagging and improves cost allocation accuracy.

- Scheduled Resource Management: Automate the scheduling of resource start and stop times. This can be useful for non-production environments, allowing resources to be automatically shut down outside of business hours. For example, automatically stop development servers at 6 PM and start them at 8 AM.

Analyzing Data Accuracy and Reliability

Ensuring the accuracy and reliability of data is paramount when evaluating a FinOps tool. Inaccurate data can lead to flawed decisions, inefficient cost optimization strategies, and a lack of trust in the tool’s capabilities. This section explores methods for validating data accuracy, comparing refresh rates, and addressing potential discrepancies.

Validating the Accuracy of Cost Data

Verifying the accuracy of cost data is essential to ensure that the insights and recommendations provided by the FinOps tool are trustworthy. Several methods can be employed to achieve this.

- Comparing Data with Cloud Provider Billing Statements: One of the primary methods involves cross-referencing the cost data generated by the FinOps tool with the official billing statements provided by the cloud service providers (e.g., AWS, Azure, GCP). This comparison helps identify any significant discrepancies between the tool’s reported costs and the actual costs. It’s important to focus on line items, resource usage, and total cost breakdowns.

- Reconciling Data with Internal Cost Centers and Budgets: Aligning the tool’s cost data with internal cost centers, departments, and budgets is another crucial step. This involves verifying that the reported costs for each cost center match the allocated budget and actual spending. This reconciliation process helps in identifying overspending or underspending, enabling timely corrective actions.

- Performing Spot Checks on Resource Utilization: Regularly verifying the resource utilization data (e.g., CPU usage, memory consumption, storage capacity) reported by the tool against the actual resource usage metrics provided by the cloud providers is important. These spot checks help ensure that the tool accurately reflects the resources being consumed. For example, if a FinOps tool reports a certain amount of CPU utilization for a specific virtual machine, this should be compared with the CPU utilization metrics provided by the cloud provider’s monitoring tools.

- Reviewing the Tool’s Data Ingestion and Processing Logic: Examining how the FinOps tool ingests, processes, and transforms the raw cost data from the cloud providers is also vital. Understanding the tool’s data pipeline, including any data transformations or aggregations, helps identify potential sources of error or inaccuracies. This might involve reviewing the tool’s documentation, querying the vendor about their data processing methods, or inspecting the data lineage.

- Conducting Data Audits: Regularly auditing the cost data generated by the FinOps tool can uncover potential issues and ensure data integrity. These audits can be performed internally or by a third-party auditor. The audit should focus on data accuracy, completeness, and consistency.

Comparing Data Refresh Rates

The frequency at which a FinOps tool updates its cost data (data refresh rate) is a critical factor in its usefulness. Different tools offer varying refresh rates, which can impact the timeliness of insights and the effectiveness of cost optimization efforts.

- Real-time Data Refresh: Some FinOps tools offer near real-time data refresh, providing up-to-the-minute cost information. This allows for immediate visibility into cost fluctuations and enables rapid responses to unexpected spending patterns. However, achieving real-time data refresh can be technically challenging and may come with increased costs.

- Hourly Data Refresh: Many FinOps tools provide hourly data refresh, which is a good balance between timeliness and resource efficiency. This refresh rate allows for frequent monitoring of cost trends and the detection of anomalies.

- Daily Data Refresh: Tools with daily data refresh may provide less granular insights, but they are often sufficient for tracking overall cost trends and identifying significant cost drivers. This refresh rate is suitable for organizations that do not require real-time cost visibility.

- Comparing Refresh Rates Across Tools: When evaluating different FinOps tools, compare their data refresh rates. Consider the organization’s needs and priorities. For instance, organizations with highly volatile workloads or a strong emphasis on cost control might benefit from a tool with a faster refresh rate. Organizations with less dynamic environments might find a slower refresh rate acceptable.

- Evaluating the Impact of Refresh Rate on Decision-Making: Assess how the tool’s data refresh rate impacts the organization’s ability to make informed decisions. For example, if a tool has a daily refresh rate, it may not be possible to immediately identify and address a sudden cost spike. Conversely, a real-time refresh rate can allow for immediate action.

Identifying and Addressing Potential Data Discrepancies

Data discrepancies can arise in FinOps tools for various reasons, including data ingestion errors, processing issues, and limitations in the tool’s capabilities. Identifying and addressing these discrepancies is essential for maintaining data accuracy and reliability.

- Common Sources of Data Discrepancies: Discrepancies can arise from several sources.

- Data Ingestion Errors: Errors can occur during the ingestion of cost data from the cloud providers. This may be due to incorrect API calls, data format issues, or network connectivity problems.

- Data Processing Issues: Problems in how the tool processes and transforms the raw cost data can lead to discrepancies. This includes incorrect calculations, data aggregation errors, and data mapping issues.

- Limitations in Tool Capabilities: The tool may not support all the features or data formats provided by the cloud providers. This can result in incomplete or inaccurate data.

- Currency Conversion Issues: If costs are reported in different currencies, errors can occur during currency conversion. This is especially relevant for global organizations.

- Methods for Addressing Data Discrepancies: Addressing data discrepancies requires a systematic approach.

- Implement Data Validation Checks: Implement data validation checks to identify and correct errors during data ingestion and processing.

- Monitor Data Quality Metrics: Track data quality metrics, such as data completeness, accuracy, and consistency, to monitor the health of the data pipeline.

- Establish a Data Reconciliation Process: Establish a process for reconciling the tool’s data with the cloud provider’s billing statements and internal cost data.

- Contact the Vendor for Support: Contact the FinOps tool vendor to report and resolve data discrepancies. The vendor should provide support and guidance.

- Regularly Review and Update Data Mapping: Regularly review and update data mapping configurations to ensure accurate cost allocation and reporting.

- Examples of Data Discrepancies and Solutions: Consider these examples:

- Scenario: A FinOps tool consistently reports a lower cost for a specific resource than the cloud provider’s billing statement.

- Solution: Investigate the data ingestion process for that resource, checking for incorrect API calls or data filtering. Verify that the tool is correctly interpreting the resource’s cost parameters.

- Scenario: The tool’s cost data for a particular cost center does not align with the allocated budget.

- Solution: Review the cost allocation rules and ensure that the resources are correctly assigned to the cost center. Verify that the tool is accurately calculating the costs for the resources within the cost center.

- Scenario: A FinOps tool consistently reports a lower cost for a specific resource than the cloud provider’s billing statement.

Assessing Security and Compliance

Evaluating a FinOps tool’s security and compliance posture is critical to safeguarding sensitive financial data and adhering to regulatory requirements. This assessment ensures that the tool not only optimizes cloud spending but also protects against data breaches and maintains the integrity of financial operations. A robust security and compliance framework is essential for building trust and minimizing risk.

Security Features to Evaluate

A thorough evaluation of a FinOps tool must include a detailed assessment of its security features. This ensures that the tool adequately protects data and operations from potential threats. Key areas of focus include access control, data encryption, and threat detection.

- Access Control and Authentication: Examine how the tool manages user access and authenticates users. This includes assessing multi-factor authentication (MFA) support, role-based access control (RBAC), and integration with existing identity providers (e.g., Active Directory, Okta). Strong access controls prevent unauthorized access to sensitive financial data. Consider the following:

- Does the tool support MFA for all user accounts?

- Is RBAC implemented, allowing for granular control over user permissions?

- Does the tool integrate with your organization’s existing identity provider?

- Data Encryption: Verify how the tool encrypts data both in transit and at rest. This protects data from unauthorized access, even if the infrastructure is compromised. Look for the following:

- Does the tool encrypt data in transit using TLS/SSL protocols?

- Is data encrypted at rest using industry-standard encryption algorithms (e.g., AES-256)?

- Does the tool manage encryption keys securely?

- Data Security: Evaluate the data protection mechanisms. Data loss prevention (DLP) and data masking are important tools for securing sensitive information. Consider the following:

- Does the tool support data masking to obscure sensitive information?

- Does the tool integrate with DLP systems to prevent data leakage?

- Threat Detection and Monitoring: Assess the tool’s ability to detect and respond to security threats. This includes evaluating its logging and monitoring capabilities, as well as its integration with security information and event management (SIEM) systems. Consider the following:

- Does the tool provide detailed audit logs?

- Does the tool integrate with SIEM systems for threat detection and incident response?

- Does the tool monitor for suspicious activity, such as unusual login attempts or data access patterns?

- Vulnerability Management: Evaluate the tool’s approach to identifying and mitigating vulnerabilities. This includes regular security audits, penetration testing, and timely patching. Consider the following:

- Does the vendor conduct regular security audits and penetration testing?

- Does the vendor have a documented process for addressing security vulnerabilities?

- How quickly does the vendor patch identified vulnerabilities?

Procedure for Verifying Compliance Certifications

Verifying a FinOps tool’s compliance certifications provides assurance that the tool meets industry standards and regulatory requirements. A structured procedure ensures a thorough assessment of the tool’s compliance posture.

- Identify Relevant Compliance Requirements: Determine the specific compliance requirements relevant to your organization and industry (e.g., GDPR, HIPAA, SOC 2).

- Review Vendor Documentation: Request and review the vendor’s compliance documentation, including certifications, audit reports, and statements of compliance. This documentation should clearly Artikel the scope of the certifications and the controls implemented.

- Verify Certification Validity: Check the validity of the certifications. Verify the certification details on the issuing body’s website to ensure the certifications are current and legitimate.

- Assess the Scope of Compliance: Determine the scope of the certifications and ensure that they cover the relevant features and data processing activities of the FinOps tool.

- Review Audit Reports: If available, review the audit reports associated with the certifications. These reports provide detailed information about the controls implemented and their effectiveness. Pay close attention to any identified weaknesses or non-compliance issues.

- Confirm Data Processing Practices: Verify that the vendor’s data processing practices align with the relevant compliance requirements. This includes data storage, data access, and data transfer practices.

- Conduct Due Diligence: Perform due diligence on the vendor to assess their commitment to compliance. This may include requesting references from other customers and evaluating the vendor’s security policies and procedures.

Examples of Tools with Robust Security Protocols

Several FinOps tools have demonstrated a strong commitment to security and compliance. These tools implement various security measures, including encryption, access controls, and compliance certifications.

- CloudHealth by VMware: CloudHealth provides comprehensive security features, including encryption of data at rest and in transit, role-based access control, and support for multi-factor authentication. CloudHealth is compliant with SOC 2 and ISO 27001.

- Apptio Cloudability: Apptio Cloudability offers robust security features, including encryption, access controls, and compliance certifications. It is compliant with SOC 2 and other relevant regulations. Apptio implements strong data protection measures to safeguard sensitive financial information.

- Kubecost: Kubecost provides strong security through its integration with Kubernetes security features and adherence to best practices. The tool’s design allows it to inherit the security posture of the underlying Kubernetes cluster. Kubecost can be configured to align with various compliance standards by leveraging Kubernetes security features and industry-standard security practices.

Evaluating Vendor Support and Documentation

Effective vendor support and comprehensive documentation are crucial for the successful adoption and ongoing use of any FinOps tool. Strong support ensures that your team can quickly resolve issues, receive guidance, and maximize the tool’s value. High-quality documentation facilitates understanding, training, and independent troubleshooting. This section explores how to evaluate these critical aspects.

Questions to Ask Vendors About Support

Understanding the vendor’s support structure is vital before committing to a FinOps tool. Inquire about their responsiveness, the channels available for assistance, and the levels of support offered. The following points Artikel the key areas to investigate:

- Support Channels: Determine the available channels for support, such as email, phone, chat, and a dedicated support portal. Assess the availability of each channel and the expected response times.

- Service Level Agreements (SLAs): Inquire about the vendor’s SLAs, including guaranteed response times for different severity levels of issues. Understand the escalation procedures for unresolved problems.

- Support Team Expertise: Investigate the expertise of the support team, including their FinOps knowledge, experience with cloud platforms, and familiarity with the tool’s functionalities.

- Onboarding and Training: Understand the onboarding process, including the level of assistance provided during initial setup and configuration. Inquire about the training resources available to help your team learn the tool.

- Proactive Support: Ask about proactive support measures, such as regular check-ins, performance monitoring, and alerts to identify potential issues before they impact your operations.

- Availability: Confirm the availability of support, including the hours of operation and whether support is available 24/7 or during specific business hours.

- Customer Success Management: Inquire if the vendor offers a dedicated customer success manager to assist with the tool’s adoption, optimization, and ongoing support.

- Escalation Procedures: Clarify the escalation procedures for complex issues that cannot be resolved by the initial support team.

- Community Support: Determine if the vendor provides a community forum or other channels where users can share knowledge and find solutions.

Demonstrating the Quality of the Tool’s Documentation

Comprehensive and well-structured documentation is essential for users to understand and effectively utilize a FinOps tool. High-quality documentation reduces reliance on vendor support and empowers users to self-serve solutions. Evaluate the documentation based on the following characteristics:

- Accessibility: Ensure the documentation is easily accessible, whether online, downloadable as PDFs, or integrated within the tool itself.

- Clarity and Conciseness: Assess the clarity and conciseness of the documentation, ensuring it uses plain language and avoids technical jargon where possible.

- Completeness: Verify that the documentation covers all aspects of the tool, including features, functionalities, configurations, and troubleshooting.

- Organization: Evaluate the organization of the documentation, including the use of clear headings, subheadings, and a table of contents for easy navigation.

- Searchability: Test the search functionality within the documentation to ensure users can quickly find relevant information.

- Up-to-Date Information: Confirm that the documentation is regularly updated to reflect the latest features, bug fixes, and changes to the tool.

- Examples and Tutorials: Look for examples, tutorials, and use cases that demonstrate how to use the tool in various scenarios.

- Visual Aids: Evaluate the use of visual aids, such as diagrams, screenshots, and videos, to enhance understanding.

- Troubleshooting Guides: Check for comprehensive troubleshooting guides that provide solutions to common issues.

Training Resources Offered by Different Vendors

Vendors often provide various training resources to help users learn and master their FinOps tools. These resources can range from self-paced online courses to instructor-led training sessions. Evaluating these resources helps determine the level of support available for your team’s skill development.

- Online Courses: Many vendors offer online courses that cover the tool’s features, functionalities, and best practices. These courses are often self-paced and can be accessed anytime. For instance, a vendor might provide a series of modules on cost optimization, resource allocation, and reporting.

- Instructor-Led Training: Some vendors provide instructor-led training sessions, either in-person or online, where users can interact with experts and ask questions. These sessions often cover advanced topics and hands-on exercises.

- Webinars and Workshops: Webinars and workshops are frequently offered to provide insights into specific features, use cases, and best practices. These events can be live or recorded for later viewing.

- Documentation and Guides: Comprehensive documentation, including user manuals, quick start guides, and API documentation, serves as a fundamental training resource. These resources explain the tool’s features and how to use them effectively.

- Certification Programs: Some vendors offer certification programs to validate users’ knowledge and skills in using the tool. These programs can enhance credibility and demonstrate expertise.

- Community Forums: Online community forums provide a platform for users to ask questions, share knowledge, and learn from each other. These forums are often monitored by vendor support staff.

- Example: Consider a FinOps tool vendor that provides a “FinOps Fundamentals” online course, a “Cost Optimization Deep Dive” webinar series, and a “Certified FinOps Professional” program. These diverse offerings cater to different learning styles and skill levels.

Structuring a Pilot Program

Implementing a pilot program is a critical step in evaluating a third-party FinOps tool. This controlled environment allows you to assess the tool’s capabilities, integration, and overall fit within your organization before a full-scale deployment. A well-structured pilot program minimizes risks and maximizes the chances of a successful implementation.

Setting Up a Pilot Program

The successful execution of a pilot program requires careful planning and execution. The following steps Artikel the process:

- Define Objectives and Scope: Clearly articulate the goals of the pilot program. What specific aspects of the FinOps tool are you testing? Define the scope, including the specific cloud accounts, services, and teams involved. This will help to focus the evaluation and measure success effectively.

- Select Participants: Choose a representative group of users who will participate in the pilot. Consider including members from different teams (e.g., engineering, finance, operations) to gather diverse perspectives. The size of the pilot group should be manageable while still providing sufficient data for analysis.

- Establish Success Metrics: Identify key performance indicators (KPIs) that will be used to measure the pilot program’s success. These metrics should align with the objectives of the pilot.

- Configure the Tool: Set up the FinOps tool within the pilot environment. This includes connecting to your cloud provider accounts, configuring data ingestion, and setting up any necessary integrations. Ensure the tool is properly configured to collect and process relevant data.

- Train Participants: Provide adequate training to the pilot participants on how to use the tool. This training should cover all the necessary features and functionalities. Proper training ensures that the participants can effectively use the tool and provide meaningful feedback.

- Monitor and Collect Data: Actively monitor the tool’s performance and collect data on the defined success metrics. This includes tracking cost savings, identifying optimization opportunities, and gathering user feedback.

- Analyze Results: Analyze the collected data to assess the tool’s performance against the defined success metrics. Evaluate the tool’s strengths and weaknesses based on the data and user feedback.

- Document Findings and Provide Feedback: Document the findings of the pilot program in a comprehensive report. Provide feedback to the vendor based on your experience and the results of the pilot. This feedback can help the vendor improve the tool.

- Make a Decision: Based on the results of the pilot program, make a decision about whether to proceed with a full-scale deployment of the FinOps tool.

Pilot Program Evaluation Report Template

A well-structured evaluation report is crucial for summarizing the pilot program’s findings and making informed decisions. The following template provides a framework for your report:

- Executive Summary: Provide a brief overview of the pilot program, including the objectives, scope, and key findings.

- Objectives: Clearly state the goals of the pilot program.

- Scope: Describe the specific cloud accounts, services, and teams involved in the pilot.

- Methodology: Explain the approach used to conduct the pilot program, including the duration, participants, and data collection methods.

- Results: Present the findings of the pilot program, including data on cost savings, optimization opportunities, and user feedback.

- Success Metrics: Summarize the pilot’s performance against the defined success metrics.

- Strengths: Highlight the strengths of the FinOps tool based on the pilot program’s results.

- Weaknesses: Identify the weaknesses of the FinOps tool based on the pilot program’s results.

- Recommendations: Provide recommendations for the vendor based on the pilot program’s findings.

- Conclusion: Summarize the overall assessment of the FinOps tool and make a recommendation on whether to proceed with a full-scale deployment.

- Appendix: Include any supporting documentation, such as screenshots, data tables, and user feedback.

Pilot Program Success Metrics Examples

Defining and tracking appropriate success metrics is essential for determining the effectiveness of the FinOps tool. The following examples provide guidance on metrics to consider:

- Cost Savings: Measure the actual cost savings achieved during the pilot program. This can be calculated by comparing the costs before and after implementing the FinOps tool. For example, if a company spent $100,000 on cloud services before the pilot and the FinOps tool identified and implemented cost optimization strategies that resulted in a $10,000 reduction, the cost savings would be 10%.

- Cost Optimization Opportunities Identified: Track the number of cost optimization opportunities identified by the tool. This includes identifying unused resources, right-sizing instances, and implementing reserved instances. A company that identifies 50 optimization opportunities can improve its efficiency.

- Time to Insight: Measure the time it takes to gain insights into cloud spending and identify cost-saving opportunities. A shorter time to insight indicates a more effective tool. If a company reduces its analysis time from one week to one day using the FinOps tool, it improves efficiency.

- Accuracy of Data: Assess the accuracy and reliability of the data provided by the tool. This includes verifying that the tool accurately reflects cloud spending and resource utilization. For example, if the tool consistently underreports actual costs, it may not be reliable.

- User Adoption and Satisfaction: Measure the adoption rate and user satisfaction with the tool. This can be done through surveys, interviews, and usage statistics. High user adoption and satisfaction indicate that the tool is easy to use and provides value to the users. A company might measure user satisfaction using a Net Promoter Score (NPS), aiming for a score above 50.

- Efficiency Gains: Measure improvements in operational efficiency, such as reduced manual effort in cost reporting or faster incident resolution related to cloud spending.

Cost-Benefit Analysis

Evaluating a FinOps tool requires a thorough cost-benefit analysis to determine its value and ensure it aligns with your organization’s financial goals. This analysis goes beyond simply comparing price tags; it involves quantifying potential savings, understanding all associated costs, and assessing the overall return on investment (ROI). A well-executed cost-benefit analysis will help you make an informed decision and justify the investment in a FinOps tool.

Calculating Return on Investment (ROI) of a FinOps Tool

Determining the ROI of a FinOps tool involves estimating the benefits it provides and comparing them to the total cost of ownership. This requires a proactive approach, where potential cost savings and efficiency gains are carefully measured.To calculate the ROI, use the following formula:

ROI = ((Benefits – Costs) / Costs) – 100

Here’s a breakdown of the key components:

- Benefits: These represent the financial advantages derived from using the FinOps tool. They often include:

- Cost Savings: Reduced cloud spending through optimization, right-sizing, and resource allocation improvements. For example, a company might save 15% on its AWS bill by identifying and eliminating idle resources.

- Increased Efficiency: Automation of tasks, reduced manual effort, and improved team productivity. Consider a scenario where the tool automates instance resizing, freeing up engineering time; this is a quantifiable benefit.

- Improved Forecasting: More accurate cloud cost predictions, enabling better budgeting and financial planning.

- Reduced Risk: Proactive identification and mitigation of potential cost overruns and security vulnerabilities.

- Costs: These represent the total expenses associated with the FinOps tool. They include:

- Tool Subscription Fees: The recurring cost of the tool itself.

- Implementation Costs: Expenses related to setting up and configuring the tool, including professional services or internal staff time.

- Training Costs: Expenses related to training staff on how to use the tool effectively.

- Ongoing Maintenance: Costs associated with maintaining and updating the tool.

For example, imagine a company spends $100,000 annually on a FinOps tool. The implementation and training cost an additional $20,The tool helps the company save $30,000 annually on cloud costs, and the increased efficiency saves the company $10,000 in engineering time (estimated based on salaries and project timelines). The ROI calculation would be:

ROI = (($30,000 + $10,000 – ($100,000 + $20,000)) / ($100,000 + $20,000)) – 100 = -75%

In this scenario, the ROI is negative, indicating the investment has not yet paid off. This highlights the importance of careful benefit estimation and cost control. However, the company should analyze the long-term impacts.

Comparing Pricing Models of Different FinOps Tools

FinOps tools employ a variety of pricing models, and understanding these models is crucial for budget planning and comparing different vendors. The optimal pricing model depends on your organization’s size, cloud spending, and specific needs.Here are some common pricing models:

- Subscription-Based Pricing: This is a popular model, where you pay a recurring fee (monthly or annually) for access to the tool. The fee may be based on:

- Number of Users: Pricing scales based on the number of users who have access to the tool. This model is suitable for organizations with a defined user base.

- Cloud Spend Percentage: The fee is a percentage of your overall cloud spending. This model aligns the vendor’s success with your cost savings, but it can become expensive as your cloud spend increases. For instance, a tool might charge 1% of your AWS bill.

- Features and Functionality: Pricing tiers may offer different feature sets. Basic tiers provide core functionalities, while higher tiers include advanced features such as automation and complex reporting.

- Usage-Based Pricing: You pay only for the resources you consume. This model is often based on the amount of data processed, the number of API calls, or the number of resources monitored. This model is suitable for companies with fluctuating cloud usage.

- Tiered Pricing: Pricing is structured into tiers based on usage volume or feature sets. As your usage increases, you move to a higher tier with a different price. This can be a good option if your usage is predictable.

- Custom Pricing: Some vendors offer custom pricing plans based on your specific requirements. This is often used for large enterprises with complex needs.

Consider a comparative analysis of two FinOps tools. Tool A offers a flat monthly fee of $5,000, while Tool B charges 0.75% of your cloud spend. If your monthly cloud spend is $500,000, Tool B would cost $3,750. However, if your cloud spend reaches $800,000, Tool B would cost $6,000, making Tool A the more cost-effective option. This demonstrates the importance of evaluating your current and projected cloud spend when comparing pricing models.

Identifying Hidden Costs Associated with FinOps Tool Implementation

Beyond the stated price, several hidden costs can significantly impact the total cost of ownership of a FinOps tool. Identifying and accounting for these costs is crucial for accurate budgeting and financial planning.Here are some potential hidden costs:

- Implementation and Integration Costs:

- Professional Services: Many tools require professional services for initial setup, configuration, and integration with your existing systems. These services can add significantly to the overall cost.

- Internal Staff Time: Your internal IT staff will need to dedicate time to the implementation process, which can impact their productivity on other projects. This includes time spent on data migration, API integrations, and user training.

- Training and Onboarding Costs:

- Training Materials and Workshops: Ensure adequate training for your team to use the tool effectively. These costs may include vendor-provided training, internal training programs, and ongoing support.

- Learning Curve: There’s a learning curve associated with any new tool. During this period, your team may experience decreased productivity as they become familiar with the tool.

- Ongoing Maintenance and Support Costs:

- Support Fees: Some vendors charge extra for premium support, which may be necessary for complex environments or urgent issues.

- Customization and Development: If you need to customize the tool to meet your specific requirements, you may incur additional development costs.

- Updates and Upgrades: Regular updates and upgrades are essential for maintaining the tool’s functionality and security. You might need to allocate resources for managing these updates.

- Data Migration and Cleanup Costs:

- Data Migration: Transferring your existing cloud cost data to the new tool can be time-consuming and may require specialized skills.

- Data Cleaning: You may need to clean and standardize your cloud cost data to ensure accuracy and consistency.

- Opportunity Costs:

- Resource Allocation: The time and resources spent on implementing and managing the FinOps tool could potentially be used for other initiatives.

For example, a company initially estimates the cost of a FinOps tool at $10,000 per year. However, after implementation, they discover they need to hire a consultant for $5,000 to customize the tool to integrate with their existing monitoring systems. They also need to allocate $2,000 for internal staff time spent on training and data migration. The total cost of ownership becomes $17,000, highlighting the importance of considering all potential hidden costs.

Designing a Comparative Matrix

Creating a comparative matrix is a crucial step in evaluating FinOps tools. This structured approach allows for a systematic comparison of various tools based on pre-defined criteria, making it easier to identify the best fit for your organization’s specific needs. By visually representing the strengths and weaknesses of each tool side-by-side, you can make a more informed decision.To effectively compare different FinOps tools, a well-designed matrix is essential.

This matrix should facilitate a clear and concise comparison of features, pros, and cons. It serves as a central repository of information, streamlining the evaluation process and enabling data-driven decision-making.

Comparative Matrix Structure and Criteria

A comparative matrix is a table that organizes the evaluation criteria for each FinOps tool. It uses columns to represent the different tools being evaluated and rows to represent the evaluation criteria. This structure enables a side-by-side comparison, highlighting the strengths and weaknesses of each tool. The following example demonstrates a basic structure:

| Feature | Tool A | Tool B | Tool C |

|---|---|---|---|

| Cost Visibility | Excellent | Good | Average |

| Cost Optimization Recommendations | Good | Excellent | Poor |

| Reporting and Analytics | Good | Good | Excellent |

The example above provides a basic framework. However, a comprehensive matrix should include more detailed criteria. Consider the following categories and examples for scoring each tool:

- Cost Visibility: This assesses how well the tool provides insights into cloud spending.

- Granularity: Does the tool offer detailed cost breakdowns by service, resource, and tag? (Excellent, Good, Average, Poor)

- Real-time Data: How frequently is the cost data updated? (Near Real-time, Daily, Weekly, Delayed)

- Customizable Dashboards: Can users create custom dashboards to visualize cost data? (Yes, Partially, No)

- Recommendation Accuracy: How accurate are the tool’s cost optimization recommendations? (High, Medium, Low)

- Automation Capabilities: Does the tool automate the implementation of cost-saving measures? (Fully, Partially, None)

- Rightsizing Recommendations: Does the tool suggest optimal resource sizes? (Yes, Partially, No)

- Report Generation: Does the tool generate customizable reports? (Yes, Partially, No)

- Data Visualization: Does the tool offer effective data visualizations? (Excellent, Good, Average, Poor)

- Trend Analysis: Does the tool allow for trend analysis of cloud spending? (Yes, Partially, No)

- API Integration: Does the tool offer API integration for data export and automation? (Yes, Partially, No)

- Alerting and Notifications: Does the tool provide alerts and notifications for cost anomalies? (Yes, Partially, No)

- Integration with Cloud Providers: How well does the tool integrate with the major cloud providers (AWS, Azure, GCP)? (Excellent, Good, Average, Poor)

- Data Source Reliability: Is the data sourced from reliable sources? (Yes, Partially, No)

- Data Latency: How quickly is data available? (Near Real-time, Daily, Weekly, Delayed)

- Data Validation: Does the tool validate the accuracy of the data? (Yes, Partially, No)

- Data Encryption: Does the tool encrypt data at rest and in transit? (Yes, Partially, No)

- Compliance Certifications: Does the tool comply with relevant industry standards (e.g., SOC 2)? (Yes, Partially, No)

- Access Control: Does the tool offer robust access control and user management features? (Yes, Partially, No)

- Support Availability: What are the support channels and availability? (24/7, Business Hours, Limited)

- Documentation Quality: Is the documentation comprehensive and easy to understand? (Excellent, Good, Average, Poor)

- Training and Onboarding: Does the vendor provide training and onboarding resources? (Yes, Partially, No)

Each criterion should be scored using a consistent scale (e.g., Excellent, Good, Average, Poor, or a numerical scale like 1-5). This allows for a quantifiable comparison.For each tool, document the pros and cons related to each criterion. This provides context and justification for the scores assigned. For example:

- Tool A – Cost Visibility:

- Granularity: Excellent (Provides detailed cost breakdowns by service, resource, and tag.)

- Pros: Very granular data, allowing for deep dives into cost drivers.

- Cons: The interface can be overwhelming for users unfamiliar with cloud cost analysis.

By meticulously filling out this matrix, you can create a clear and objective comparison of the FinOps tools being evaluated. The comparative matrix enables a data-driven decision-making process.

Conclusive Thoughts

In conclusion, evaluating a third-party FinOps tool requires a multi-faceted approach, from understanding core FinOps principles to meticulously analyzing features and functionalities. By leveraging the evaluation criteria Artikeld in this guide, organizations can navigate the complexities of the FinOps landscape and select a tool that not only meets their immediate needs but also supports long-term cloud cost optimization strategies. The key is a thorough assessment, a well-defined pilot program, and a commitment to continuous improvement in cloud financial management.

FAQs

What is the difference between a FinOps tool and a cloud provider’s native cost management tools?

FinOps tools often provide more advanced features, such as cross-cloud visibility, automated recommendations, and integration with third-party services, which can provide more insights than native tools. They also can offer features such as budget forecasting, and automated rightsizing, which can be lacking in native tools.

How do I determine the ROI of a FinOps tool?

Calculate ROI by comparing the tool’s cost (including licensing, implementation, and maintenance) with the cost savings achieved through optimized cloud spending. This involves tracking cost reductions, identifying efficiency gains, and quantifying the value of improved decision-making.

What security certifications should I look for in a FinOps tool?

Look for certifications like SOC 2, ISO 27001, and compliance with relevant industry regulations (e.g., GDPR, HIPAA). These certifications indicate that the vendor has implemented robust security controls and follows industry best practices.

How long should a pilot program for a FinOps tool last?

A pilot program typically lasts for 1-3 months. This timeframe allows sufficient time to test the tool’s features, evaluate its performance, and gather enough data to make an informed decision about its long-term suitability.